We don’t believe in the traditional one-size-fits-all approach. Instead we’re led by your needs and hopes. In this way we offer professional financial advice not just to the wealthy, but to everyone.

Which advice level is best for you?

We believe financial advice should be for everyone. We achieve this with both traditional person-to-person interaction, and cutting-edge financial technology.

Take our short quiz to see our recommended advice level, or scroll below to choose yourself.

My Seventy Portal

Get a clear, uncomplicated view of your finances in one place. Your investments, savings, pensions, insurances, mortgages, loans and property alongside all the associated paperwork.

- View your investment portfolio

- Quickly access your insurance details

- Set up reminders for important financial events

- Securely store all your important documents

- Track your property values

4 steps to success

At Seventy Financial Planning, we use a four-step process to create your plan.

Fact Finding

First things first, we must get to know you.

This is really important, for we need a deep understanding of your objectives and desires to plan effectively. This is how we differ from traditional one-size-fits-all financial advice. The problem with the one-size-fits-all approach is that, in practice, it fits no one. At Seventy we don’t believe in this approach. Instead we’ll be led by your needs and hopes.

Preparation

In our opinion, this is the most valuable step in the process.

We use all our understanding about you to establish the feasibility, and likelihood, of your needs and hopes becoming a reality. It is our aim to use the result of this step as the blueprint to guide our recommendations.

Implementation

Should you instruct us to proceed with our recommendations we will:

handle all fund and policy administration on your behalf, provide regular updates to keep you informed of progress, ensure all your documents are issued in line with your expectations, and provide confirmation of all actions taken on your behalf in writing.

Annual Review

Financial planning is an ongoing process.

Even once your plan is underway it must be reviewed annually. We’ll be in touch to conduct your review. It’s effectively the periodic repeating of the above three steps. We will re-visit our cash-flow modelling, discuss the full range of our on-going services and consider the ongoing suitability of your plan.

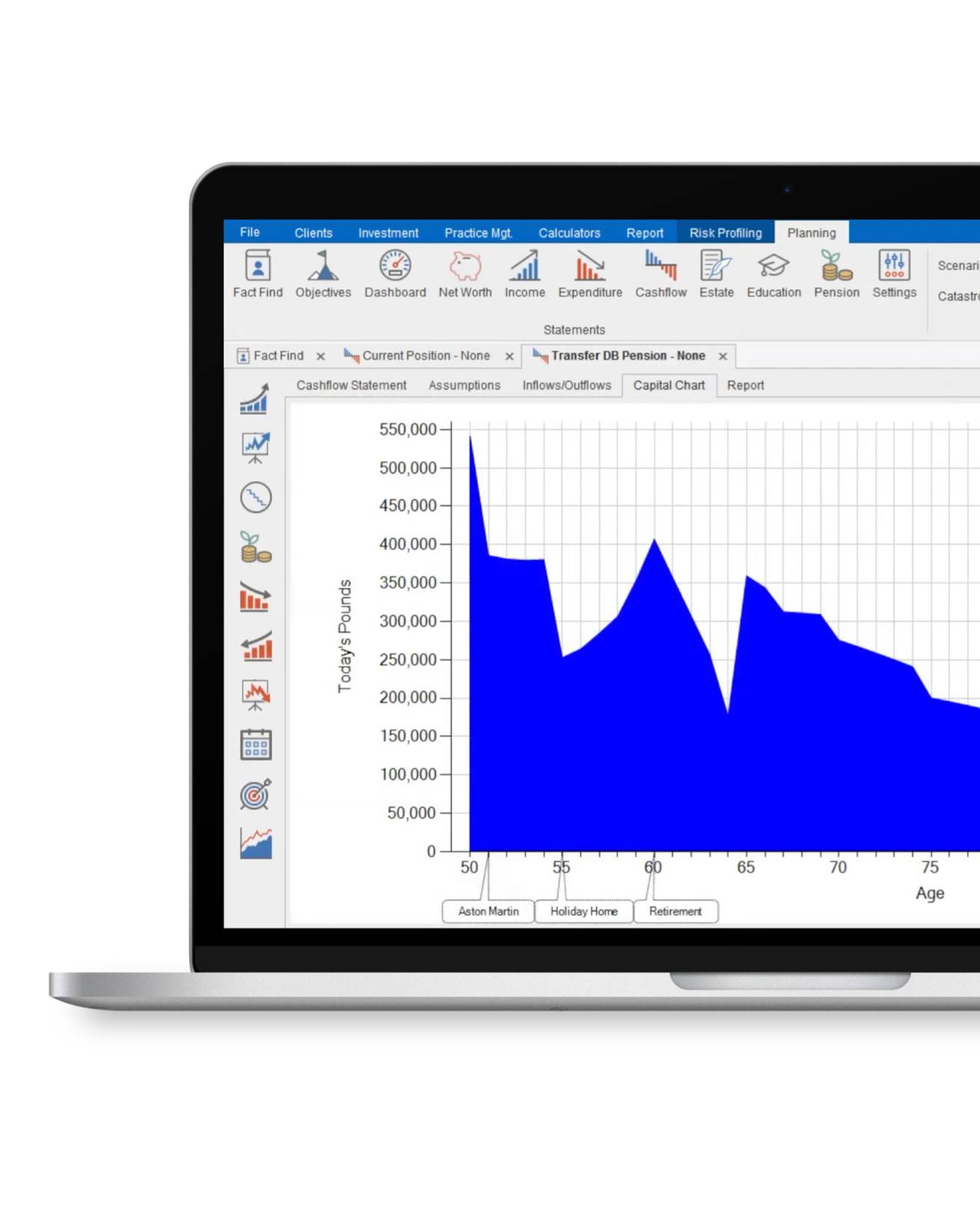

Cashflow Planning

Seventy’s cashflow planning software makes it easy to visualise your financial future and gain deep insights into your financial well-being. Visualise your goals and achieve financial freedom.

- See the impact of your financial decisions

- Visualise your income, assets, liabilities, and goals

- Answer big questions about earnings or early retirement

- Identify excess money and do more of what you enjoy

- Model the impact of various "what if" scenarios